Module 1- Industry Structure

This module provides a basic understanding of under what circumstances site acquisition and permitting are performed in the wireless infrastructure sector.

Module Overview:

Module 1 Industry Structure Learning Objectives

Upon completion the learner will be able to:

- Describe types of communications carriers

- Explain the difference between MLAs & SLAs

- Cite current trends in the wireless industry

- Explain how and why FirstNet was created

- Explain key site acquisition consultant traits

- Discuss federal regulation of frequency Spectrum

- Explain wireless build-to-suit agreements

- Explain the role of the site acquisition

- Find top tower site owner websites

- Describe the Telecom Act of 1996

- The impact of the Middle-Class Tax Relief & Job Creation Act of 2012

- Determine when a tower is substantially increased by a collocation

- Identify real estate entitlements secured by site acquisition

Introduction to Wireless Industry Structure, Module 1

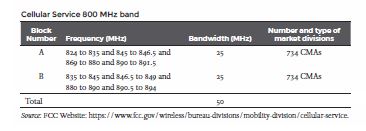

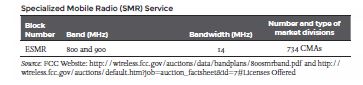

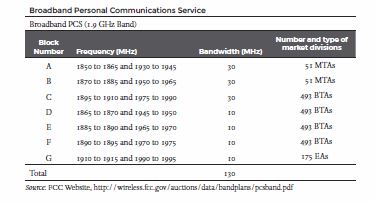

Traditional cellular telephone carriers provide what is known and regulated by the Federal Communications Commission (FCC) as commercial mobile radio service (CMRS) or commercial mobile service. The focus of this text is larger in scope, encompassing the mobile wireless marketplace that includes frequency spectrum and infrastructure facilities.

This first module about wireless industry structure explains some general parameters about the commercial mobile services sector of the telecom industry that support an argument for the importance of real estate permits and property entitlements to facility-based wireless operators.

Topic 1- Facility-Based Telecommunications Operators

There are two types of communications carriers are:

Mobile Network Operators (MNOs) or facility-based carriers

Mobile Virtual Network Operators (MVNOs) are those without their own facilities

MVNOs buy network capacity from MNOs, package it, and resell communications

services to the public.1 This text refers only to wireless carriers that are facilities-

based and the development of those facilities.

Facility-based wireless carriers are engaged in capital investment, site acquisition,

infrastructure development, and network operations, both on their own and thru

contracts with infrastructure developers, tower companies, equipment suppliers,

turf vendors, and contractors. Tower companies provide wireless carriers with

build-to-suit opportunities and sale-leaseback financing, as well as space leasing

and site development services. Wireless equipment suppliers design, manufacture,

and implement infrastructure products and systems. Turf vendors manage entire

contract deployment programs including site acquisition, construction, and

project management personnel.

Topic 2- Sale-Leaseback and Build-To-Suit Transactions

Several of the largest wireless carriers have a history of selling large portfolios of tower sites to tower companies in exchange for cash— billions of dollars of cash. The carriers use the cash to buy frequency spectrum and to build new wireless facilities. Sale-leaseback deals result with the carrier, as a tenant, paying a pre-arranged rent to the tower company, as the new site owner. This significant flow of cash in the wireless business has been occurring for the past twenty years.1

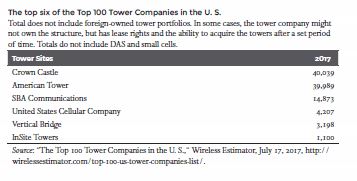

Several years ago, large carriers were making public statements about how the business model of site management companies needed to change. It has changed through the rapid growth of microcell site technology which is discussed in Module 4 Wireless System Design. Currently, a few tower companies own many thousands of antenna structure assets, as do wireless carriers.2 It’s not getting easier to build new antenna tower structures, especially in highly populated areas with restrictive local permit regulations and where competition for use of vacant land is high.

Wireless carriers continue to develop new antenna sites on their own and on the structures of others. Meanwhile, tower companies actively pursue opportunities to build antenna structures for wireless carriers under build-to-suit (BTS) arrangements and master lease agreements (MLAs). Carriers are now seeking antenna placement on poles in public rights-of-way (PROW) and network connections to these antennas via fiber-optic cable also located in rights-of-way (ROW) to extend network coverage and system capacity.

Topic 3- Collocation Agreements

Where it is not feasible to build a new antenna structure, wireless facilities may be collocated on an existing structure. The large national wireless carriers have established MLAs among themselves and with tower companies. MLAs specify processes, provide guidelines, and facilitate site space agreements between business entities. An exhibit template for individual site leases or license agreements (SLAs) is attached to each MLA. Each new SLA becomes an exhibit to the MLA to add equipment to an existing structure, presumably already loaded with the equipment of other wireless providers. (For more on collocations see Module 3 Site Acquisition Contracting; Module 7 Search Area Assignment; Module 17 Collocation Applications; and Module 23 Collocation Agreements.)

Topic 4- Wireless Trends

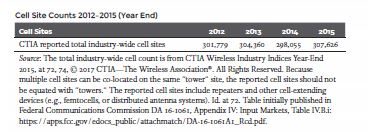

The wireless world has experienced many explosive changes over the past 10 years, including the expectation that mobile data traffic over wireless systems will increase a thousand-fold, the effect this growth has on the number of cell sites needed to handle the traffic, how small antenna sites (with minimal demands for space) are utilized as a strategy to serve areas where traditional cell site facilities aren’t feasible, the entrance into the wireless market by a national satellite operators and a national government-sponsored public safety network (the equivalent of another national carrier network), and the rapidly increasing value of fiber-optic transport systems joining traditional cell sites to small antenna facilities (fronthaul) and linking cell sites to mobile switching centers, data centers, and other network hubs (backhaul). Another trend has been cable television MSOs getting into the wireless business, and finally Congress authorizing tens of billions of dollars to all US states through numerous government programs. A logical question to ask is, “What’s driving the wireless mobile traffic explosion?”

The answer is two-fold. One driver is mobile video. Mobile video signals consume much greater amounts of wireless network transmission capacity than a voice conversation or standard email attachment. Video media transmissions have taxed the wireless thoroughfare in recent years, but they bring advertising dollars. The penetration of smartphones for ages thirteen and older has grown to 81 percent in the past twelve years.1 The other driver is the plethora of new data and remote-control applications that operate over wireless networks. Compared to the meteoric growth and impact of cellular phones and personal communications over the past thirty years, it can be said at this time, “You ain’t seen nothing yet!” Proficient wireless site acquisition and permitting specialists are in high demand.

Topic 5- State of the Art Technology

Small Cells, 5G, and the Internet of Things

The number of cell sites in the US could multiply by a factor of ten in the future, according to former FCC chair Tom Wheeler.1 Fifth-generation wireless, or 5G, is associated with wireless connections to the internet of things (IoT), including smart city technology and self-driving cars.2 The IoT refers to the evolution of state-of-the-art big data, cloud-edge computing, data centers, fiber-optic transport, and wireless technology. It’s about expanding the growth in such markets as smart home technology, remote sensing, machine-to-machine communications, and analytics to just about any device that can be monitored, actuated, and analyzed. Water companies reading residential meters and parking meters using wireless gear are early existing applications of the IoT.

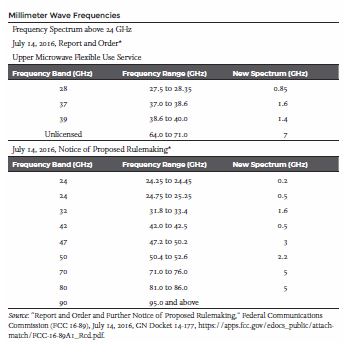

While 5G is growing, it is expected to blossom throughout this decade. Microcell sites are expected to lead the way. The frequency spectrum has been tested to support the expanded development of microcell site technology and 5G applications in the new frequency spectrum.3 In addition to the frequency spectrum, also known as wireless broadband, all wireless facilities require real estate rights or entitlements. Small cells, 5G, and the IoT will require significant wireless site and permitting efforts through the 2020s by qualified consultants.

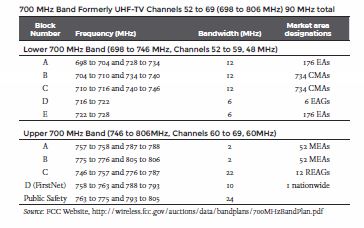

Topic 6-First Responder Network Authority (FirstNet)

One dynamic expansion of wireless infrastructure in recent years has been in the public safety sector. The program, called FirstNet,1 is an independent authority within the National Telecommunications and Information Administration (NTIA)2 whose mission is to provide law enforcement, firefighters, paramedics, and other emergency service first responders with a nationwide, high-speed, broadband network dedicated to public safety. FirstNet was created by the Middle-Class Tax Relief and Job Creation Act of 2012, Section 6204. The goal of FirstNet was to build and connect public safety wireless infrastructure nationwide by 2022.

The program suffered initial bureaucratic setbacks but eventually got on track. A private-public partnership was established to deploy the Nationwide Public Safety Broadband Network (NPSBN). “We have the people, the processes, and the infrastructure in place to ensure a successful public-private partnership to deploy the Network,” said FirstNet CEO Mike Poth. “As an advocate and steward for public safety, it is our job to ensure the Network meets their needs and objectives. FirstNet stands ready for this awesome responsibility.”3 On March 28, 2017, the FirstNet board of directors authorized Mike Poth, its Chief Executive Officer, to proceed to award the contract to procure the NPSBN.4 On March 30, 2017, FirstNet formally announced its partnership with AT&T to build the NPSBN.5 Every state has vast areas that will require the development of new structures for wireless facilities, elevating the need for qualified professional wireless site acquisition and permitting services nationwide.

Small Cells, 5G, and the Internet of Things

The number of cell sites in the US could multiply by a factor of ten in the future, according to former FCC chair Tom Wheeler.1 Fifth-generation wireless, or 5G, is associated with wireless connections to the internet of things (IoT), including smart city technology and self-driving cars.2 The IoT refers to the evolution of state-of-the-art big data, cloud-edge computing, data centers, fiber-optic transport, and wireless technology. It’s about expanding the growth in such markets as smart home technology, remote sensing, machine-to-machine communications, and analytics to just about any device that can be monitored, actuated, and analyzed. Water companies reading residential meters and parking meters using wireless gear are early existing applications of the IoT.

While 5G is growing, it is expected to blossom throughout this decade. Microcell sites are expected to lead the way. The frequency spectrum has been tested to support the expanded development of microcell site technology and 5G applications in the new frequency spectrum.3 In addition to the frequency spectrum, also known as wireless broadband, all wireless facilities require real estate rights or entitlements. Small cells, 5G, and the IoT will require significant wireless site and permitting efforts through the 2020s by qualified consultants.

Topic 7- Dish Network Corporation (DISH)

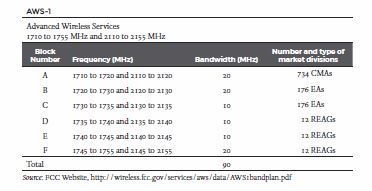

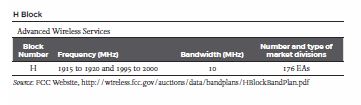

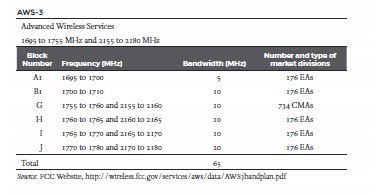

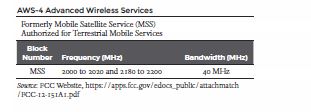

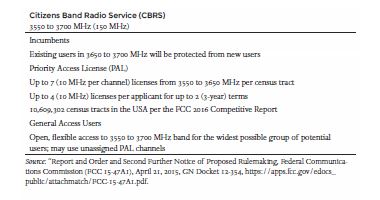

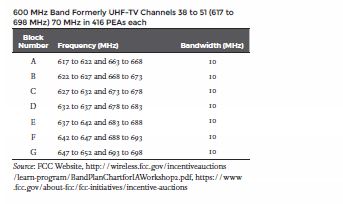

Late in 2012, the FCC removed regulations on 40 MHz of underutilized satellite communications frequency spectrum held by Dish Network Corporation by allowing the spectrum in the AWS-4 band to be utilized nationally for terrestrial communications.1 Additionally, DISH has purchased frequency spectrum in FCC auctions in the AWS-3, H block, 600 MHz, and 700 MHz bands.

DISH held off for several years from declaring how it intended to deploy its frequency spectrum while experimenting extensively with wireless broadband.2 There have been numerous deadlines. The FCC placed buildout requirements for DISH to implement the spectrum. December 20, 2013, an FCC Opinion and Order concerning DISH spectrum called for 40 percent signal coverage by the AWS-4 licenses within four years or a 70 percent buildout within seven years.3 DISH petitioned and received a waiver allowing it eight years to perform the buildout by early 2021.

On July 31, 2019, DISH unveiled a new plan for its network buildout based on the proposed T-Mobile-Sprint merger.4 Under the agreement made between T-Mobile, Sprint, DISH, and the Anti-Trust Department of the Department of Justice (DOJ) DISH was required to deploy a national network capable of serving 20% of the U.S. population by June 14, 2020. Wireless site acquisition and permitting activity by DISH was ongoing since 2018 for the NB-IoT Network. The NB-IoT Network development was shut down and activities were reactivated toward the new goal of building a fourth national wireless carrier 5G standalone network.5 DISH has further committed that its facilities-based 5G broadband network will be capable of serving 70 percent of the U.S. population by June 14, 2023. Extensive nationwide wireless site acquisition and permitting activity has been ongoing and can be expected to continue for years to come, albeit predominantly collocations from the beginning changing over to new ground sites over time.

Topic 8- Fiber-Optic Transport Networks

Attesting to the value of fiber-optic transport systems in the wireless ecosystem is the number of fiber networks purchased by wireless carriers and tower companies in recent years. With its latest agreement to acquire Wilcon Holdings, LLC, in April 2017, tower industry giant Crown Castle brought under its control 28,000 route miles of fiber.1 In January 2017 Crown completed an acquisition of FPL FiberNet Holdings, netting 11,500 route miles of fiber. In August 2015 Crown completed the purchase of Quanta Fiber Networks, Inc. (Sunesys), and in 2014 Crown acquired 24/7 Mid-Atlantic Network LLC.2 The business opportunity for tower companies in fiber-optic transport is the horizontal placement of users along the transport route, not unlike users located vertically on a communications tower, according to Crown Castle CEO Jay Brown.3

AT&T Fiber serves fifty-one metro areas as of February 2017, with sixteen more on the way. The AT&T internet protocol backbone includes 410,000 route miles of optical fiber to which AT&T Mobility has access.4 In one purchase during March 2016, Verizon Wireless purchased XO Communications’ fiber network business, including 20,000 inner-city route miles and 13,000 metro route miles.5 In April 2017 Verizon Wireless struck a deal with Corning, Inc., to manufacture 12.4 million miles of optical fiber a year for the next three years.6

Besides these developments, industry consolidation is occurring in the fiber business. On October 31, 2016, CenturyLink and Level 3 announced merger plans.7 The two companies own 450,000 route miles of optical fiber combined. On February 27, 2017, Windstream announced the completion of its acquisition of Earthlink, increasing Windstream’s fiber route miles to 145,000. Communications Sales and Leasing, Inc., (spun off from Windstream in 2015) merged two other companies (PEG Bandwidth LLC and Tower Cloud, Inc.) earlier in 2017 to create Uniti Group,8 a real estate investment trust (REIT) with 4.2 million strand miles of fiber, 486 tower facilities, and 235,200 route miles of copper cable.9 On March 1, 2017, Zayo Group Holdings, Inc., announced that it closed on its purchase of Electric Lightwave, adding over 12,000 route miles to its network, now at 126,000 route miles in North America and Europe, according to Zayo’s website.10

Telecom Ramblings posted links to network maps for over thirty of the largest fiber-optic networks in 2009. Some maps have been updated by operators, others haven’t.11 The large-scale development of metro area and long-haul fiber-optic transport networks in the US started in the 1980s. It could be said that the fiber-optic transport business grew up during the same time-frame as the wireless industry. The two didn’t really get acquainted for twenty-five years, during which time many considered them competitors. Now, after thirty-five years, they are married to each other and planting trees (small cell sites) around the world. The growth of fiber-optic transport services (FOTS) in public and private rights-of-way represents a significant business opportunity for wireless site acquisition and permitting as well as right-of-way consultants.

Topic 9- Government Regulation

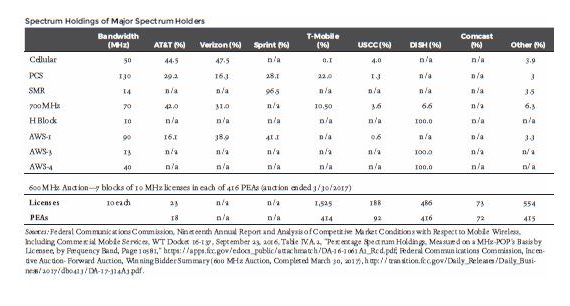

Since frequency spectrum is allocated by the FCC on behalf of the federal government to existing and would-be wireless carriers, the FCC is obliged to serve as the lead government agency to regulate the commercial mobile services or wireless industry. Numerous federal laws and actions foster the creation, development, nurturing, and protection of the commercial mobile services sector, including arrangements to increase frequency spectrum availability.1 As such, federal regulatory oversight is an ongoing critical aspect of the wireless industry structure.

For instance, a provision in Section 704 of the Telecommunications Act of 1996 restricts local jurisdictions from prohibiting or having the effect to prohibit the provision of personal wireless services, unreasonably discriminating among providers of functionally equivalent services, and “regulating the placement, construction, and modification of wireless facilities on the basis of the environmental effects of radio frequency emissions to the extent that such facilities comply with” federal regulations.2

In Section 6409(a) of the Middle-Class Tax Relief and Job Creation Act of 2012, local governments are mandated not to deny but instead to approve permit requests for collocations on existing wireless towers, as long as the physical dimensions of the existing tower are not substantially increased.3 These and other actions by the federal government further national siting policy for wireless facilities.

During his term as chairman of the FCC (from January 2016 to January 2020), Ajai Pai oversaw extensive work on telecommunications siting policy as was the case with local and state agencies, as well, 4 considering the numerous undertakings of the FCC, the US Congress, and state legislatures.5 This was precipitated in December 2016 by a petition by Mobilitie to the FCC aimed at accelerating wireless/wireline broadband deployment by removing barriers to infrastructure investment 6 that became FCC Notices of Proposed Rulemaking (NPRMs) and Notices of Inquirie (NOIs) in March 2017. 7 The petition and follow-up activity was a result of treatment being received by wireless carriers from jurisdictions stressed over development applications for microcell sites (‘small cells’).

Upon becoming FCC chairman, Pai immediately called for the development of an FCC Broadband Deployment Advisory Committee (BDAC). 8 Working committees of the BDAC were formed of industry leaders to investigate and develop a basis to streamline regulations. After extensive work by the BDAC committees and sub-committees over an eighteen-month period, three FCC Reports & Orders (R&Os) & Declaratory Rulings were promulgated to speed deployment of next-gen wireless infrastructure regarding 1.) local moratoriums, 2.) to institute a one-touch make-ready rule for pole attachments in PROW to speed access to utility poles, and 3.) to set standards for small cell applications specifying limits on the authority of local governments. 9

As a result of further inquiry initiated by the Wireless Industry Association (WIA), the FCC issued a clarification of previous rules on October 27, 2020, known as “Implementation of State/Local Governments’ Obligation to Approve Certain Wireless Facility Mod Requests under Section 6409(a) of the Spectrum Act of 2012” to provide for a streamlined review of requests to add limited space at the bottom of existing towers for backup power, low-latency computing, and for multiple providers to be housed at one site (within 30’ of the existing site) not to be considered a ‘substantial change.’ Finally, existing structures no longer required existing wireless antennas to be considered wireless structures for collocation purposes. 10

In another notable action, a US District Court on September 17, 2020, ruled in favor of CTIA, finding that Berkeley, CA’s ordinance be preempted by a 2019 FCC RF update that found “even if certified or otherwise authorized devices produce RF exposure levels in excess of Commission limits under normal use, such exposure would still be well below levels considered to be dangerous, and therefore phones legally sold in the United States pose no health risks.” 11

Over 30 states have passed legislation to modernize and streamline rules for small cells in the public right of way … for responsible, sustainable, and expedited deployment. 12

These changes in regulatory oversight and their impact on wireless communications will be addressed in relation to the content of this text as appropriate.

Topic 10- Site Acquisition

Wireless site acquisition consultants (SACs)—or, as they represent wireless facility developers to property owners and communities, site acquisition agents—perform and manage tasks to secure real estate entitlements for wireless infrastructure investment, construction, and operation on behalf of wireless carriers, fiber-optic transport carriers (fibercos), towercos, equipment suppliers, turf vendors, and specialty contractor firms. Our clients are, therefore, wireless site investors, developers, and operators. Once sites are constructed and operational, the wireless carrier and the site owner become facility operators, though they may be one in the same.

Criteria for securing real estate entitlements are initiated by our client or project sponsor, specified in the wireless search area design, and implemented through architectural and engineered drawings to secure space rights and local permit rights. The process to obtain space and local permit rights is called site acquisition. Site acquisition tasks are major hurdles not to be taken for granted in wireless facility development. Priorities constantly rule how time is spent in the site acquisition process. The goal is to avoid or overcome obstacles that may delay the implementation of wireless infrastructure or break project budgets. Site developers and investors desire efficient as well as careful site acquisition performance. If deadlines aren’t met, project funding may evaporate. Time is of the essence.

Topic 11- Project Management

Site acquisition is planned and performed in an organized project context. Work assignments are composed of numerous tasks and subtasks. Each task is assigned a start date, a duration period, and a resulting completion date. Receipt of search areas, also known as search rings, is the starting point for site acquisition activities. Search areas are designed by radio frequency (RF) engineers for the acquisition of new sites to meet carrier coverage objectives. Site acquisition consultants are accountable to a client point of contact directing the real estate development portion of the project, usually a real estate specialist or project manager.

Upon receipt of the search areas, the initial site acquisition tasks are to evaluate, locate, and identify existing structures, zoning districts, code regulations, real property ownership, and environmental considerations such as bodies of water, floodplains, potential interference, and air navigation conflicts. Detailed due diligence efforts are undertaken to qualify candidate locations for the site selection process. Such activities are discussed further in Module 8 Search Area Mapping; Module 9 Zone-ability; Module 10 Constructability; and Module 11 Lease-ability.

After site selection, the project context changes to the development of the selected location. Preparation of a site selected for construction includes the development of engineered drawings, acquisition of space rights, and permit rights procurement. While site acquisition tasks may be complete once a site is ready to build, until and after the facility is operational the site acquisition consultant may be called upon for ongoing assistance. The process of preparing sites for construction is discussed in Module 16 Project Initiation; Module 27 Final Space Rights; and Module 28 Local Permit Applications.

Members of the overall project team include the client point of contact (Topic 2), a radio frequency (RF) engineer (Topic 3), a construction manager (Topic 4), an attorney (Topic 8), an architecture and engineering (A&E) firm (Topic 6), a surveyor (Topic 6), draftsmen (Topic 6), a title insurance company (Topic 6), a structural engineer (Topic 6), and an environmental consultant (EC) (Topic 7). Conference calls with the client point of contact (Topic 2) are common on a weekly basis to discuss current details affecting the site acquisition progress of each site or project. Externally, site acquisition consultants (Topic 1) are engaged in meeting the public and representing the client to property owners, county and municipal authorities, and neighborhood groups.

A more in-depth treatment of project management applied to the context of this book is offered in the Summary (Module 33 Project Manager Training.)

Topic 12- Values Expected of Site Acquisition Consultants

It’s useful to exhibit positive values in the conduct of site acquisition business, consistent with client expectations. Below is a list of values that benefit the wireless site acquisition mission and the environment in which we work.

Hardworking, as evidenced by preparation, accomplishment, and productivity. It is the result of enthusiastic effort, self-motivation, and the ability to set priorities and manage time. This includes expediting permits and leases, reporting, and preparing for public hearings.

Adaptability to changing circumstances in managing projects demonstrates creative problem solving, situational flexibility, resourcefulness, mental resiliency, and the ability to simplify complex issues into manageable actions.

Tenacity in negotiating circumstances is a demonstration of confidence, determination, and persistence to resolve complications and meet deadlines.

Reliability is demonstrated through accountability, dependability, discipline, focus, compliance with client procedures, punctuality, a responsible nature, and consistent communications and service to the client, project team, and customers.

Integrity involves discipline, cooperation, authenticity, genuine courtesy, honesty, and the avoidance of conflicts of interest. We earn trust from our concern and consideration for others. Effective negotiations require integrity.

Sensitivity regards the ability to understand dynamics behind the scenes, work effectively with team members, understand property owner motives, and read personality traits to perceive potential roadblocks and adjust accordingly. Site search and selection, relationships with property owners and local planners, and public hearings particularly require sensitivity to the sway of the meeting.

Cultural values such as these represent virtues that can be nurtured and developed personally. The importance of espousing these values can’t be overemphasized in the context of the project management environment and the representation of wireless clients to property owners, jurisdictional authorities, and neighborhood groups.

DO YOU ASPIRE TO RESEMBLE THESE VALUES?

Topic 13- Site Acquisition Specializations

The Sections of this Handbook lend themselves to study as sub-specializations within the overall context of wireless site acquisition and permitting. For instance, this first, orientation section of six chapters/ modules provides an appropriate context for the entry-level roles of project coordinator, real estate specialist, and administrative support to get a career started in the wireless deployment environment. The next, site search due diligence section of six chapters/modules is also branded as birddog training, how to find the good sites. The third, site selection analytics section of three chapters/modules regarding project data reporting and project cost estimating is branded project estimator training, working with the project team and internal systems to choose the best overall site to develop. These three sections a/k/a levels of training combine overall to compose wireless site selection training, a volume of content unto itself.

The fourth, project preparations section of five chapters/modules of this Handbook begins the second volume of content regarding wireless site development. It is the project expediter training of initiating and tracking the processes that enable quality real estate entitlements to be successfully secured and finalized. The fifth, space rights leasing agent section of seven chapters/modules specifically refers to securing space rights agreements branded leasing agent training. The sixth, local permit rights section of four chapters/modules supports the development of zoning and building permit procurement expertise through local permit consultant training.

Additional perspective on the content in this Handbook yields specialized training for those engaged in processing collocations with focus provided in Module 17, Collocation Applications, and Module 23, Collocation Agreements, for those engaged in processing title work with focus provided in Module 18, Title Commitments, for those engaged in collaborating with architectural and engineering design specialists with focus provided in Module 19, Standard Engineered Drawings and Reports, and Module 20, Supplemental Engineered Drawings and Reports, for those engaged as close-out specialists with focus provided in Module 27, Final Space Rights, Module 31, Local Governing and Public Hearings, and the Conclusion (Project Close-Out), and for those engaged interested in program/project management through focus on the Summary (Module 33 Project Manager’s Training).